Breadtalk is a well-known bakery brand in Singapore. Its current market cap is SGD 325m, trading at P/E of 40x. Wait, why is the P/E so high?

High P/E is usually associated with

- High Price for high growth potential OR

- Low earnings, which could be due to:

- Latest earnings fell sharply but the market thinks it’s temporary

- One-off loss, such as impairment

- Low net margin (e.g. 1-2%), which the market thinks it will normalize to higher average in future

- Others

Many investors invest based on P/E as their guidance. High P/E means expensive, and low P/E means cheap. Investing is not as simple as that. If you are an investor who usually invest based on P/E only, then you better make sure what the E = Earnings is about. Taking the latest earnings without any adjustment as the guidance to judge expensive or cheap is often a mistake.

For Breadtalk’s case, to understand whether its P/E of 40x is justified, we have to look at its businesses. Using the blended earnings to value the Company will be a mistake if the underlying businesses have different prospect and return.

Breadtalk has 3 businesses, all in F&B:

- Bakery – operating Breadtalk bakery (retail + franchising)

- Restaurant – operating restaurants

- Food Atrium – operating food courts

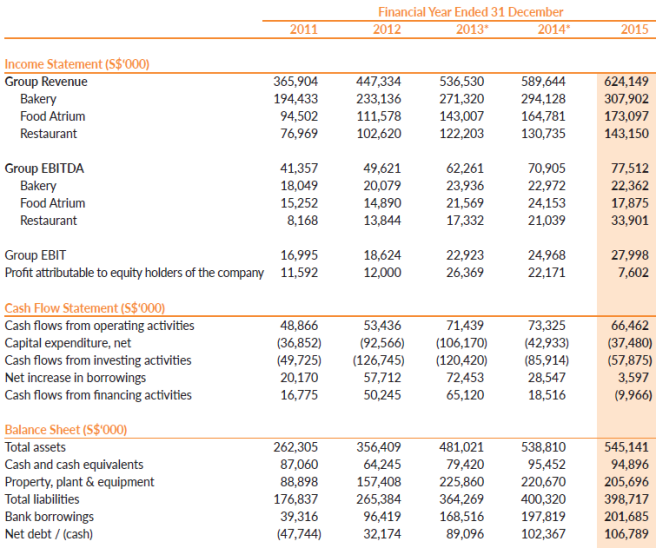

Source: FY15 Annual Report

Its FY15 annual report shows that bakery contributed 49% of revenue, restaurant 23%, food atrium 28%. In terms of EBITDA, bakery contributed 29%, restaurant 44%, food atrium 23%. These percentages didn’t change much for 9M16. Therefore, the restaurant business contributed more to the earnings than bakery.

Source: FY15 Annual Report

EBITDA vs EBIT

In the company’s presentation and management discussion, EBITDA is the highlight instead of EBIT. The company should really report both. Depreciation is a real cost to business (although it can easily be manipulated by accounting). Retail F&B has to spend big capex to renovate the stores for the first time and continue spending to maintain the stores. Some shopping malls require that the stores get renovated after 5 years in operation. Therefore, the big renovation capex does not happen only once in a store’s lifetime.

Some shopping malls in China may have very short lease term, such as one year. Therefore, the high renovation and furniture capex have to be depreciated over just one year, dragging down bottom line. If the store extends the lease after one year, the renovation cost will actually be spread over longer period, hence the previously reported depreciation was overstated and the bottomline understated. This could argue to look at EBITDA instead of EBIT. But that short term lease is indeed a risk to the business. Management can highlight both EBITDA and EBIT for each business and let the investors decide themselves which numbers are useful to them.

Breadtalk Business

We won’t go into too much detail about its three businesses (operations, strengths, weakness, management quality, competition, etc), which can take a lot of effort and pages. That will be a very long post, especially when we cover three businesses across different geography, and most people will give up reading halfway, or maybe not even halfway. Maybe stop here. But, what I want to point out are 1) Breadtalk’s earnings are dragged down by its food court business and bakery business in China, 2) Non-Controlling Interests takes away the most juicy part of the meat.

1. Restaurant business

Source: Breadtalk’s Annual Reports

From 2011 to 2015, revenue grew 2x, but EBIT grew 6.6x because the margin increased from 5% to 18%. In FY15, EBIT margin nearly doubled from 9.7% in FY14 to 18% because the Management consolidated some of the restaurant operations and implemented stringent cost control. It closed all three RamenPlay restaurants in Shanghai (again, many Singapore companies failed to run restaurants profitably in China) and two underperforming restaurants in Singapore. So, FY14 margin was impacted by write-off of PPE.

18% EBIT margin for FY15 was impressive. Many listed restaurant businesses in Singapore achieve only single digit EBIT margin in current business environment. Some are low single digit and in the red.

Since restaurant is the biggest contribution to Breadtalk’s earnings, you will want to check if latest earnings is sustainable. Most of the earnings come from Ding Tai Fung restaurants. I didn’t expect it to do so well.

For 9M16, the EBIT margin drops to 14.7%, and you’ll notice that for 9M15, the EBIT margin was actually 13.2%.

Source: Breadtalk’s Annual Reports

Question: How could the EBIT margin rose from 13.2% for 9M15 to average 18% for full year FY15?

9M15 achieved EBIT of 14.1m, and FY15 achieved EBIT of 25.8m. That’s 11.7m increase for Q4 alone in 2015. I looked for any explanation in Q4 report but found none. I also searched for broker reports for 15Q4 and none explained the gap. Quarterly report is not audited, so the numbers could be adjusted for full year financial statement. Perhaps, that’s the reason. But, by following this logic, does that mean that we can expect FY16 EBIT margin to be substantially higher than its 9M16 margin?

I believe the closure of RamenPlay in Shanghai and Singapore did help the Company save several millions. But, store closures will usually be associated with some property and equipment written off, a one-off charge to the P&L. My conclusion is I can’t reconcile the 9M15 and FY15 numbers. To be conservative, I’ll take the lower margin in the quarterly report. The good news is that 9M16 did better than 9M15, partly because of closures of underperforming restaurants.

Revenue for 9M16 was 4.92% higher than 9M15. Assuming Q4 does the same, FY16 estimated revenue can achieve 150m. Based on improved operating margin of 13.5%, the estimated EBIT is roughly 20m for FY16. Whether or not 13.5% is sustainable depends on the business environment and how well the management manage this restaurant business. Please, do not go into fast expansion mode at the expense of low return.

More than 90% of the restaurant revenue came from Singapore operation, while the balance came from Thailand. I believe the Singapore’s Ding Tai Fung is also more profitable than Thailand. Singapore’s corporate tax rate is 17% and Thailand’s 20%. If we take blended average, it’s close to 17%.

Capex spending has become moderate for the past three years. The capex is actually lower than the depreciation charge for the past three years. Hence, revenue growth has slowed down to mid single digit. But, ROA is high (above 15%), so it’s still very profitable and creating values to shareholders.

Non-Controlling Interests (NCI)

When you look at the FY15 annual report, you’ll notice that net profit was 14.6m, but profit attributable to owners of the Company was just 7.6m. Nearly half belonged to Non-Controlling Interests (NCI). Why?

Refer to Note 14 of FY15 annual report for information on NCI.

The profit before tax for subsidiaries with material NCI was 26.7m. Among the three businesses, which one generated that much PBT? Yes, it’s the restaurant.

The NCI has 30% stake in the restaurant, and I believe, it should be the original owner of Ding Tai Fung, who licensed to Breadtalk to operate in Singapore and Thailand (and soon, London). That is bad because 30% of the most profitable business belongs to someone else, not the shareholders of Breadtalk. Therefore, we have to cut the earnings by 30%.

Valuation of Restaurant business

Normally I will use DCF, but for Breadtalk, let’s try to use a simple P/E multiple. For this restaurant profile and performance (high margin and ROA), we can assign P/E of 15-20x. That’s quite a wide range. I’ll take the P/E 15 – 18x range for base and bull case.

- Revenue = 150m.

- EBIT margin = 13.5%.

- EBIT = 20m.

- Tax Rate = 17%.

- Net Profit = 16.6m.

- NCI = 30%.

- PATMI = 11.6m.

- Base Valuation = 11.6m x 15 P/E = 174m.

- Bull Valuation = 11.6m x 18 P/E = 209m.

For a business that is generating 150m revenue and 11.6m net profit (after 30% NCI), I value it at 174-209m. That’s P/S of 1.16 – 1.39x.

2. Bakery business

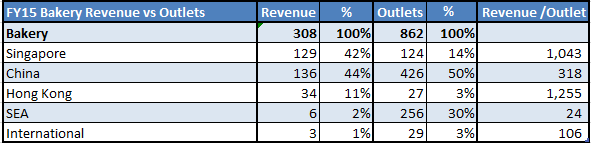

Source: Breadtalk’s Annual Reports

Looking at the revenue contribution within Bakery business, we can safely assume that stores in Singapore and Hong Kong are self-operated with each store generating over SGD 1m per year. Stores in SEA and International are mostly franchisees. Stores in China have mixed model (self-operated + franchise). Out of 426 stores in China, I estimate that a quarter are self-operated and the balance are franchise.

Within Bakery business, there are really three different profiles:

- Singapore and Hong Kong (self-operate)

- China (self-operate)

- Franchise (China, SEA, International)

We do not have the profit per category above, so it’s harder to analyze each one. Given the strong Breadtalk brand in Singapore, its good locations in shopping malls and premium prices, I believe that are doing quite profitably. The stores in HK have even higher revenue per store than those in SG. I assume they have similar performance with good return. Franchise business will be quite profitable, but it’s relatively small to the overall bakery revenue. The problematic one is self-operated stores in China. This should be the one dragging down the overall profitability. If the self-operated stores in China are not doing well, do you think the franchise stores in China can do well? I don’t think so. If the poor return continues, franchisees will eventually quit the business.

Source: Breadtalk’s Annual Reports

From FY10 to FY15, revenue nearly doubled, but EBIT fell 44% as EBIT margin dropped from 5.7% to just 1.7%! ROA (before tax) dropped from decent 11.56% to just 2.8%. They invested a total of 109m in capex from FY10 to FY15, but generated total EBIT of only 50.6m. At some point, the additional investment during that period was actually destroying shareholder value. Growth generates value only when its return is higher than the cost of capital. In this case, the growth is destroying value.

For 9M16, the bakery business closed some outlets and had tighter cost control. Its revenue dropped due to weakness in China’s franchise business. The operating margin improved to F11-FY13 level of 4-5%. Will this be sustainable? I don’t know. What I think is bakery business needs to stop the store expansion and should focus on consolidating its business and closing non-performing stores. If it can’t self-run the overseas stores profitably, just franchise it. Let the local entrepreneurs run the business and be happy with the franchise income. This will also help reduce the capital investment. Breadtalk has a strong brand in Singapore, but I don’t think it has as strong brand in China. Further, the culture and taste preference of the locals there are different.

In consumer business, you will often see data on consumption per capita. For example, for Milk consumption, China has consumption of 11kg per capita, Japan 31kg, US 90kg, Australia 110kg. For bread set consumption, China has consumption of 1.3kg per capita, Japan 6.8kg, Singapore 8.1kg. Given that the consumption per capita of Chinese population is much lower than that of developed countries, we assume that there is so much room to grow. Further, if we look at the total consumption in China over the years, it’s increasing steadily. This reasoning is supported with data.

But, let’s do one analogy. China’s GDP is growing at 6-7% now and was growing at above 7% over past few years. Have majority of companies increased their revenues and profits over past 5 years? I don’t have all the stats. But, based on what I see from the financial statements of dozens of companies, many reported flat or lower earnings. So, as the pie is growing bigger, there are even more companies sharing the pie, hence, everyone gets smaller share. Only a few managed to get bigger share over the time.

Back to Bakery, China’s consumption of bread set is so much lower than that in Japan and Singapore. But, that doesn’t mean it will grow to anywhere close to their level. The locals may have different consumption pattern. They may not even reach half of Singapore consumption per capita in next 20 years. So, for anyone with high growth forecast, they run the risk of big disappointment. For me, the stats tell me that there is room to grow and it’s positive, but I will assume a low to mid single digit growth rate.

Valuation of Bakery business

The Company has started consolidating its bakery business. We should look at it as a turnaround business instead of a growth business now. In fact, revenue is falling slightly. With consolidation, revenue may fall more in near term.

9M16 achieved EBIT margin of 4.8%, which is slightly higher than the average in FY11-FY13. But, if we look at individual quarterly margin, Q1 and Q2 have 2.5% and 3.9% respectively, while Q3 has exceptional margin of nearly 8%. There must be some one-off gain. With such volatile margin, any assumption you make is as likely to be wrong as right. The margin also depends on how we the management consolidated this business of more than 800 outlets.

I assume that they do close down the loss-making and underperforming stores and improve the average margin to 3-4%. For tax rate, Singapore has 17%, China has 25%, and several other countries have around 25%. I assume blended average of 22%.

For P/E, given the slow growth (or negative growth) in revenue, low margin and low return business, this business deserve a lower P/E multiple. I consider the range of 12 – 15x more appropriate. For this valuation, I’ll use 13.5x.

- Revenue 300m.

- EBIT margin 3-4%.

- EBIT = 9 – 12m.

- Tax rate = 22%.

- Net Profit = 7 – 9.3m. At book value of ~180m, the ROA is 4 – 5%, still very low.

- Base Valuation = 7m x 13.5 P/E = 95m.

- Bull Valuation (EBIT margin 4%) = 9.36m x 13.5 P/E = 126m.

For a business that is generating 300m revenue and 7 – 9.3m net profit, I value it at 95 – 126m. That’s P/S of 0.3 – 0.4x only. While Breadtalk starts with Bread and has always been bread, focusing on bread, growing its bread, its bread business is worth so much less than its Restaurant business.

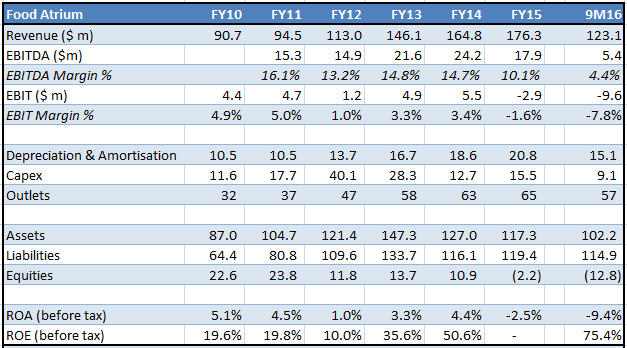

3. Food Atrium business

Source: Breadtalk’s Annual Reports

For Food Atrium, from FY10 to FY15, revenue nearly doubled, but, again, EBIT margin fell from 4.9% to -1.6%. Total capex spending during this period was 126m vs total cumulative EBIT of just 17.8m. Needless to say, the growth in this business has been destroying the shareholder values for many years. Even in its better year in FY10, the ROA was just 5.1%.

We do not have the breakdown of the profitability in different countries, so it’s harder to analyze. In FY15, out of 65 food atrium, 34 were located in China, 15 in Singapore, 8 in HK and 8 in other SEA countries. In 16Q3, the number of outlets in China fell to 29, the number in HK fell to 5. It should be the business in China that is loss-making. For closure of 9 stores this year, out of which 4 were premature in China, the Company incurred 4.8m charges on PPE write-off. That’s why 9M16 EBIT became so ugly (9.6m loss).

For a business that is so capital intensive, low return and even making losses now, it needs a huge turnaround. The business environment has changed to bad time, and shopping malls footfall are falling. If shopping malls footfall don’t rise, how can the Food Atrium business, which are located in shopping malls, do well? For being in current state, it’s not entirely the management’s mistake. The F&B environment is just tough. But the management compounded the problem with aggressive store expansion while having low return.

Valuation of Food Atrium business

The value of the business will depend on how successfully they turn it around. After closing loss-making stores, it might turn around next year to make 2-3% margin and 3-4m profit, but it will still need high capex for maintenance. After all, the value of a business depends on the free cash flow that it can generate, not reported profit figure. For now, I’ll value it zero. Perhaps I’m wrong, but I need to see a clearer picture for this business before being able to value it.

If we want to be more optimistic, and assume the turnaround is successful, it might generate 3-4m of profit. Assuming 3.5m profit, we might assign P/E of 10x for such business quality. This values it at 35m.

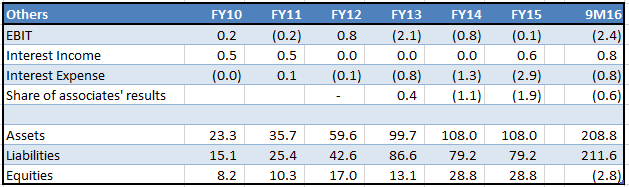

4. Others

This segment comprises the corporate services, treasury functions, investment holdings activities and dormant associated company. There is no revenue. This is really the overhead of the headquarter, and the cost fluctuate widely: -2.1m in FY13, -0.8m in FY11 and FY14, +0.8m in FY12 and -2.4m in 9M16. Any assumption you make can be as good as wrong. I’ll assume -1m on average.

Source: Breadtalk’s Annual Reports

This cost should be spread across the three businesses. The impact will increase the cost of each business, thus, reducing its profit and valuation. For now, we’ll assign P/E of 15x, so this overhead reduces the overall value by 15m.

5. Investment

As at 30 Sep 2016, Breadtalk has 192m of debt, 112.5m of cash, 90m in investment securities and 22.6m in investment property. There is also Breadtalk Headquarter that cost 64m to build and partially funded by debt.

The investment securities comprises bonds, quoted and unquoted equity instruments and redeemable preference shares. I can’t analyze how good these investment securities are and whether they will create value for the shareholders compared to the cost of borrowing. For now, I assume the value is per what’s stated in the balance sheet. Adding up the cash, investment securities and investment properties, and deducting the debt, we get 33m of net cash and cash equivalent (including illiquid non-core assets).

Lost Focus

What I think is over the years, the Breadtalk management has really lost focus. They were trying to grow three different businesses aggressively at the same time, across different regions. Also, instead of managing its capital in more straight forward manner, it invested the cash in several financial instruments, such as junior bonds with varying coupon rate, in unquoted shares of other companies and in investment properties. As a consequence, the overall financial performance suffer.

Overall Valuation of Breadtalk (Sum of the Parts)

- Restaurant: 174 – 209m.

- Bakery: 95 – 126m.

- Food Atrium: 0 – 35m.

- Overhead: -15m

- Non-core assets: 33m

- Aggregate: 287m – 388m.

Value per share: 1.02 – 1.38. This range is quite big and I can’t pinpoint a figure because the value of the business depends on how well the management turns around the business. The management has not demonstrated any experience in doing that yet.

Initially, I thought it would take shorter time to just use P/E multiple to value Breadtalk and don’t go into detail study of the business. But I still end up taking quite some time and wrote a long post.

Current market cap is 325m or 1.15 per share. Therefore, current share price has factored in some optimistic prospect for Breadtalk, assuming that it will be able to turn around its bakery and food atrium business from the low margins that it suffered in the past two years. The share price has also been trading in this range over the past years. So, in terms of efficient market hypothesis, I think the market is valuing Breadtalk quite efficiently.

Going back to the first question at the start of the post: Why is the P/E so high? We have answered it. The earnings is dragged down by losses in Food Atrium business, which had write-off of PPE due to store closure. The highly profitable restaurant business has 30% NCI, which reduces the profit attributable to shareholders by 30%.

Even though P/E is 40x, it’s trading in the middle its intrinsic value range, which I can’t pinpoint with a narrower range due to my inability to evaluate the management’s capability to turnaround the business. Therefore, I don’t think current share price of 1.15, at P/E of 40x, is high. If the share price suddenly falls by 25% and the P/E drops to 30x (which is still high as an absolute number), I might even buy (assuming the business remains as it is).

At current market price, I won’t buy. Normally, investors will invest in the company when it is expanding its stores aggressively. For Breadtalk, you want inverse. You want to invest when it is closing the loss-making stores (bakery and food atrium) aggressively. That inverse action will create more value for the shareholders.

What you want as an investor is that as Breadtalk is closing down stores and seeing its revenue falling, the general market get disappointed and sell off the shares. You will be able to pick up the shares at lower price then, increasing your return. That will need the market to be inefficient sometimes. We can’t create that. We just have to wait, patiently…

Source: Google Finance

Very good insight!

LikeLike

Your insights and research – high quality! What business are you running now?

LikeLike

My business is e-commerce and dying, unfortunately. It’s closing this year. I should have just stuck to stock investing. But any should’ve, would’ve, could’ve is pointless. It’s all learning experience to move on.

LikeLike