Global Logistic Properties Limited (“GLP”) is the leading provider of modern logistics facilities in China, Japan, Brazil and the United States. It owns and operates a USD40 billion global portfolio of 53 million sqm (573 million sqft) located across 113 cities, serving more than 4,000 customers. It’s listed in SGX and has market cap of 11.6bn now.

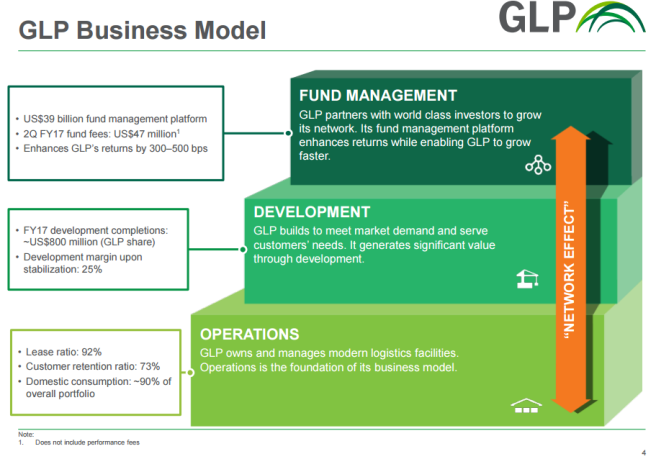

Business Model

Source: GLP’s Presentation – January 2017.

The business model is to

- Develop, own and manage the logistics facilities and lease them out to earn rent, hence, the rental revenue provides strong recurring income.

- Earn profit from property development and sale of existing properties, which might have appreciated in value.

- Earn management fees from managing the properties as some properties are co-owned with other investors

Source: GLP’s Presentation – January 2017.

Strength

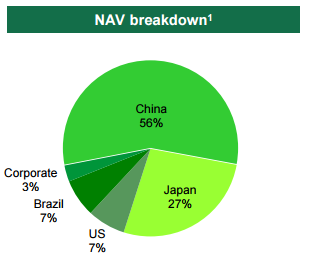

It’s the #1 market leader in China, Japan and Brazil, and #2 in US. 56% of the assets are located in China, 27% in Japan, 7% each in Brazil and US. The lease ratio of the properties are in the range 90 – 99%, meaning that it’s nearly fully leased out.

Source: GLP’s Presentation – January 2017.

Source: GLP’s Presentation – January 2017.

You can read the latest presentation report from their website, and be overloaded (or lost) with tons of data. The presentation has 42 slides, each with lots of charts, tables, and text. It’s made worse as it operates in four countries with different currencies and profile. Anyone who wants to study GLP in details will always have tons of things to read/learn but will likely be lost.

I first came across GLP in August 2013. My fund manager asked me to study it and do a SWOT analysis. From the annual reports and presentations, you will see many good points, such as being the market leader in each country it operates, high lease ratio of 90 – 99%, strong recurring income, limited supply of modern facilities in China, Japan and Brazil, rising rent, outsourcing and e-commerce trends, aggressive properties development, high domestic consumption growth in China and Brazil, etc etc, all pointing to tell you that it has high growth potential.

Source: GLP’s Presentation – January 2017.

Source: GLP’s Presentation – January 2017.

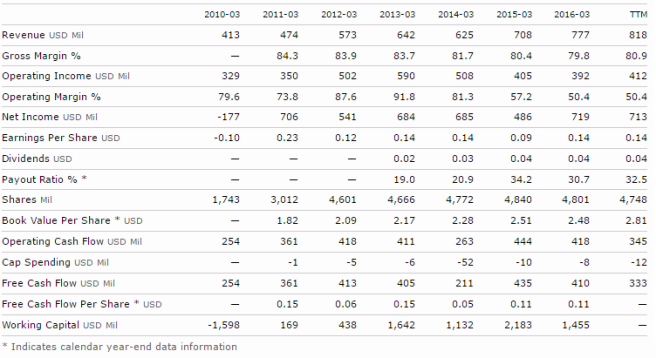

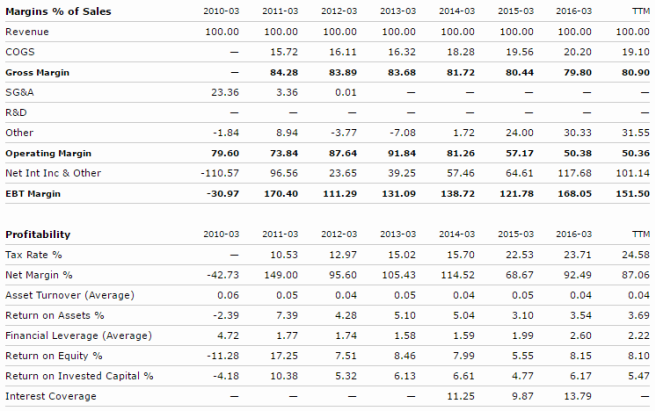

Looking at the Income Statement, you’ll be impressed with the high margin. From 2012 to 2014, the operating margin was above 80%. The Company also recorded huge gains from the appreciation of the properties. Thus, the profits reported were even higher than the revenue. That explains why the net margins are higher than operating margins.

Weakness and Risk

But something is amiss. It needs to spend BIG capital outlay to buy or build the properties and earns back slowly from the rent. This is reflected in the low ROA and ROE. The ROA was around 5% in 2014 but has fallen to 3.7% now, while ROE stays around 8%. Looking at the cash flow statement, you will see that GLP is investing aggressively to grow its properties portfolio and requires huge capital, hence the Free Cash Flow (FCF) is negative for most years. We can accept negative FCF when the Company is expanding aggressively, but we can’t accept when the growth is accompanied with such low ROE.

Besides, it has exposure to four different currencies. JPY depreciated so much against USD from 2012 to 2014 (and continued depreciating until late 2015). Brazilian Real also depreciated substantially from 2011 to 2014. It got even worse in 2015 before partially recovering in 2016. This FX risk is double-edge sword, and we can’t forecast forex.

In the end, I didn’t spend a long time studying GLP. In fact, I spent only a short time on it after seeing the consistently low ROE and the risk from forex.

The share was trading at around 16x P/E at that time, but it could be misleading because more than half of the reported earnings came from the changes in fair value of the investment properties (increase in value of the properties). We can’t be sure if the asset appreciation could really be realized or not and it could fluctuate too.

Shorting

Eventually, my fund manager shorted it. He dislikes GLP from the start. I hope he continued the short until early 2016 and covered completed after that. GLP’s share price bounced from the lows in February 2016. Today, it spiked up 7% on news that it’s seeking buyers and is requesting trading halt for now. For all existing shareholders of GLP, I hope good news is awaiting for you.

Business Owner

Now, put yourself as the business owner of GLP. Would you want to own such business which spend huge capital upfront to own the properties and earn back slowly from the rent? Yes or No?

No when you demand higher return on your invested capital.

Yes when you have too much capital, don’t know how to allocate it, not willing to take on the volatility in the stock market, see investment grade bond yield as too low, prefer low risk and want investment in physical assets that not likely to fall in values.

Sovereign wealth fund with hundreds of billions of dollar of capital, for example, fit this criteria. The investment managers have billions of dollar and have hard time to find something big to invest. When it loses money, it’ll be scrutinized heavily by the public, so it prefers low risk. Any investment in stock market will always face market volatility, and in short term, 10-20% fall can and will happen without notice. Investing in physical assets, such as warehouse, buildings, and collecting recurring rent from it give the impression that it’s relatively safe. You can easily invest billions of dollars to buy huge warehouses and buildings, so, gone is the problem of massive capital to allocate. If the asset value appreciates, you can even sell it at profit, hence giving you extra bonus on top of the rent.

Share Price Performance of GLP

Source: Google Finance

Remember, when the investment is done at low return of capital, it’s not creating value for shareholders. Look at GLP’s share price since IPO in late 2010 until now. If we omit today’s 7% rise, it’s flat for over 6 years despite the fact that revenue nearly doubled from 2011 until now, and net profit was around 480 – 720m in each year.

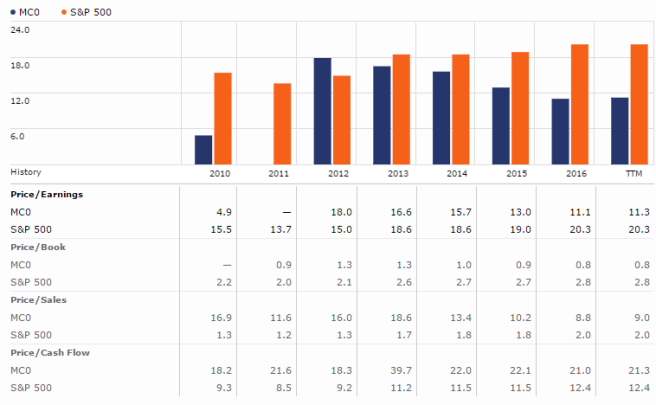

P/E multiple has fallen from 16x in 2014 to 12x now. P/B drops from 1.3x in 2013 to 0.8x now, meaning that the market values GLP below its reported net asset, despite that most of the assets are physical assets, such as warehouses. This is a large cap and followed by several sell-side analysts.

Source: Morningstar.com

Becoming Landlord after winning lottery?

Now, imagine that you hit lottery and win 10m. Many people say they will just buy several condominium units and collect rent. That provides stable income. Unleveraged residential rental yields can be around 3 – 6% (in bad times like now, it’s closer to lower end of the range). After the reading above, do you think this is still a good strategy to invest?

Again, the answer is Yes and No. No when you want higher return and are willing to take on higher risk. Yes when you have low risk profile and unable to invest more productively. There are many people who can’t sleep well when the share price is down, even temporary. So, stock market is really not for them.

REITS

In a way, GLP’s business of owning a property and leasing out is like REITs. Several REITS in Singapore give 5-7% yield, which is quite decent return. REITS are required to pay out at least 90% of its income after tax, while property stocks like GLP are not.

When investing in REITS, you are looking for most of the return from dividends. You can gain from price appreciation if you are willing to invest when the market turns bearish and is selling off. But, if your aim is to gain mostly from price appreciation, then you shouldn’t invest in REITS because common stocks provide better opportunities, though it’s associated with higher risk too. The point is you have to understand what you are investing. Then, you can set the right expectation for each investment.